The Zapper!: "SPF 10 to 1"

Posted: Friday January 5th, 2007

by

In a move announced this past November, Atari's shareholders have approved a one-for-ten reverse stock split. Essentially ten Atari shares (current trading at 1 cent each) will be combined into one share (worth 10 cents). After a long period of trading below $1 per share, NASDQ warned Atari that they were in jeopardy of being delisted. Atari has until January 18th to get their stock value above the dollar mark for at least 10 days.

Source: GameIndustry.Biz [ more info ]

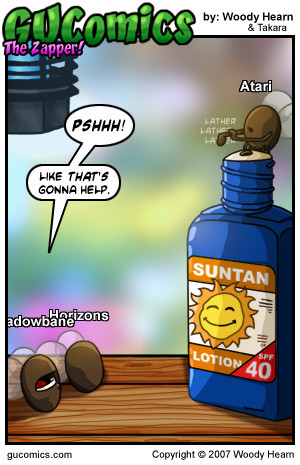

The way I see it, this is one more step toward Atari having to ring its own death knell and no amount of sunblock is going to protect them from the Zapper.

Now, maybe I'm missing something, but how does this reverse split really help them? Despite the 10 for 1 reverse split Atari would still be trading at 1/10th of NASDAQ's one dollar target. They'd have to somehow increase their current stock value ten fold, by monday, to meet the "$1 per share for ten days by January 18th" ultimatum.

Again, I'm not seeing enough details to clarify this move to me. So, if anyone else has some more info please link it.

--- Correction : ---

The GameIndustry.Biz website seems to be reporting the wrong value per share. A similar article at Gamespot indicates that Atari stock was trading at $0.57 per share at the close of business yesrday. So the 10-to-1 reverse split would make the value per share $5.70. Atari stock opened at $5.75 this morning, but dropped $0.30 to $5.45 by the close of trading today. Source: Gamespot [ more info ]

[Thanks Sturge for the heads-up.]

[ discuss ]

Source: GameIndustry.Biz [ more info ]

The way I see it, this is one more step toward Atari having to ring its own death knell and no amount of sunblock is going to protect them from the Zapper.

Now, maybe I'm missing something, but how does this reverse split really help them? Despite the 10 for 1 reverse split Atari would still be trading at 1/10th of NASDAQ's one dollar target. They'd have to somehow increase their current stock value ten fold, by monday, to meet the "$1 per share for ten days by January 18th" ultimatum.

Again, I'm not seeing enough details to clarify this move to me. So, if anyone else has some more info please link it.

--- Correction : ---

The GameIndustry.Biz website seems to be reporting the wrong value per share. A similar article at Gamespot indicates that Atari stock was trading at $0.57 per share at the close of business yesrday. So the 10-to-1 reverse split would make the value per share $5.70. Atari stock opened at $5.75 this morning, but dropped $0.30 to $5.45 by the close of trading today. Source: Gamespot [ more info ]

[Thanks Sturge for the heads-up.]

[ discuss ]

[ top ]

- advertise on gu -